Pension Settings

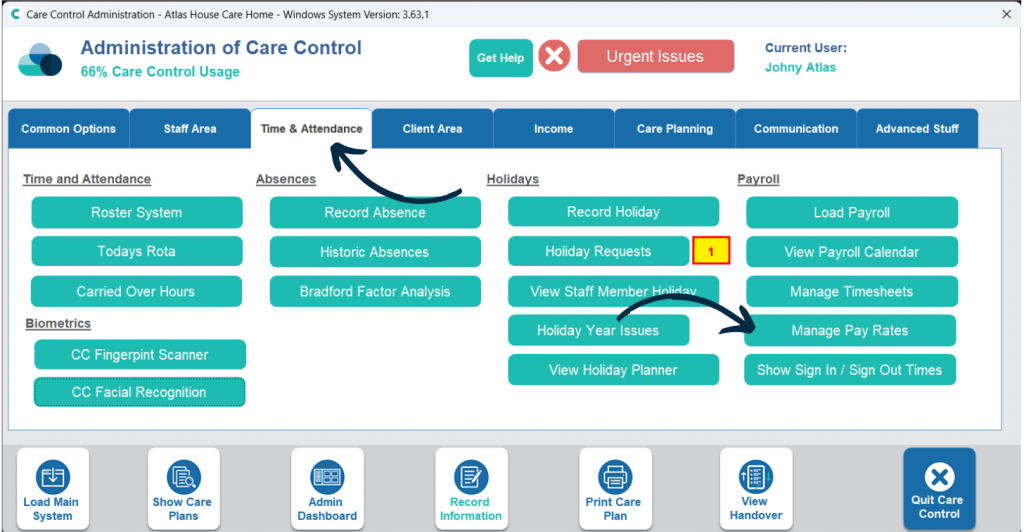

This guide will cover how to access and configure the pension settings for your staff members on an organisation wide and individual basis.

2

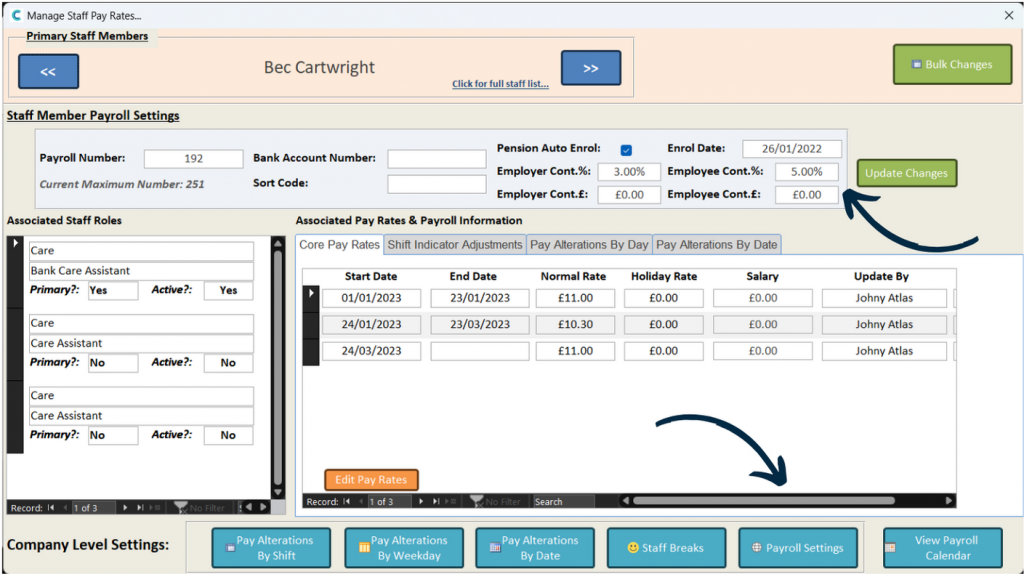

A new window will open. Here a breakdown of pay rates and other details are shown for each staff member.

In the blue shaded box on a staff members page, there are some options related to pension contributions. You can make changes here on an individual basis, simply press Update Changes after making any amendments.

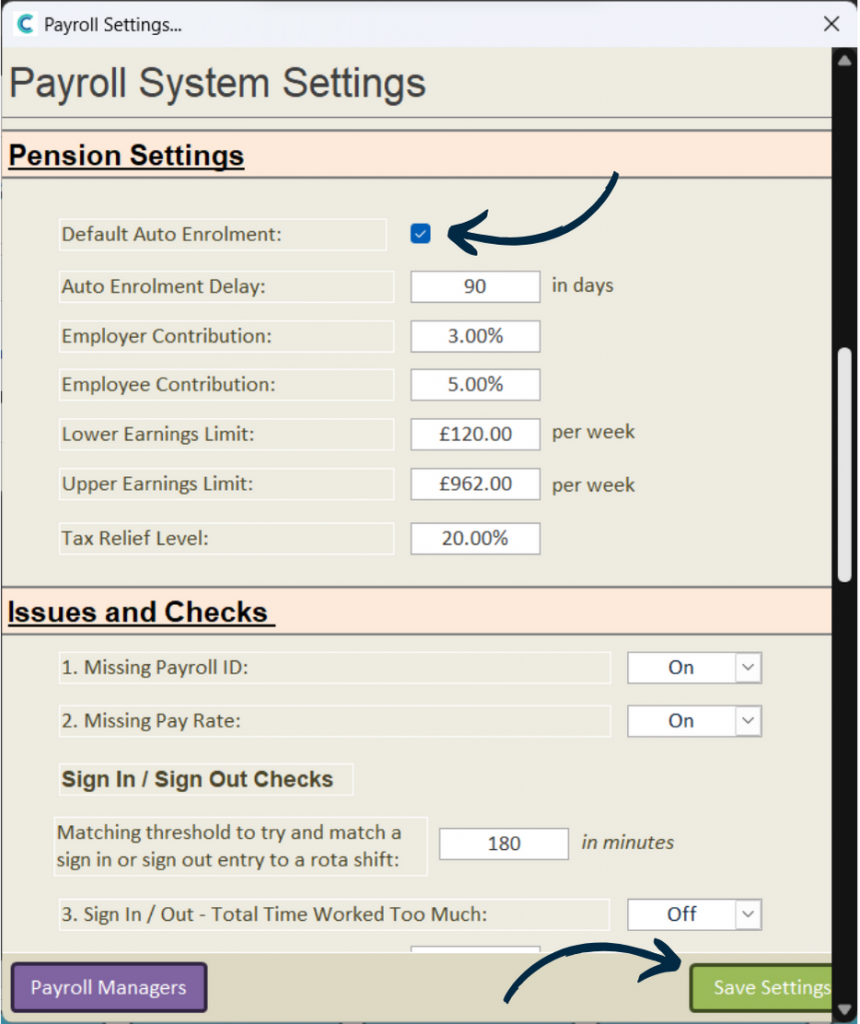

Setting | Description |

Default Auto Enrolment | When a staff member is added to the system is the default behaviour to enrol them onto the company pensions. |

Auto Enrolment Delay | As a business you can choose to delay enrolment by up to three months if you wish. The default is a 90 day delay. |

Employer Contribution | The current minimum is 3% for employers to contribute. |

Employee Contribution | The current minimum is 5% for the employee to contribute. |

Lower Earning Limit | This is the lower earnings limit per week of National Insurance contributions. Any monies below this limit does not form part of your pension calculation. |

Upper Earning Limit | This is the higher earnings limit, per week, of National Insurance contributions. Any monies above this limit does not form part of your pension calculation. |

Tax Relief | Currently set at 20%, the employee receives this on any contributions. In reality this reduces their contribution to 4%. |